AI Is Eating SaaS — And SaaS Companies Know It

For years, SaaS felt unbeatable.

Every problem had a tool. Every workflow had a dashboard. Every company, from startups to banks, slowly turned into a bundle of subscriptions. SaaS didn’t just power businesses — it defined how modern work functioned.

And yet, something subtle is happening.

SaaS isn’t disappearing. But it’s being quietly reshaped by a force that doesn’t care about dashboards, feature lists, or renewal cycles. AI is no longer just improving software. In many cases, it’s starting to replace what the software was meant to do in the first place.

This isn’t a loud collapse. It’s a silent re-architecture.

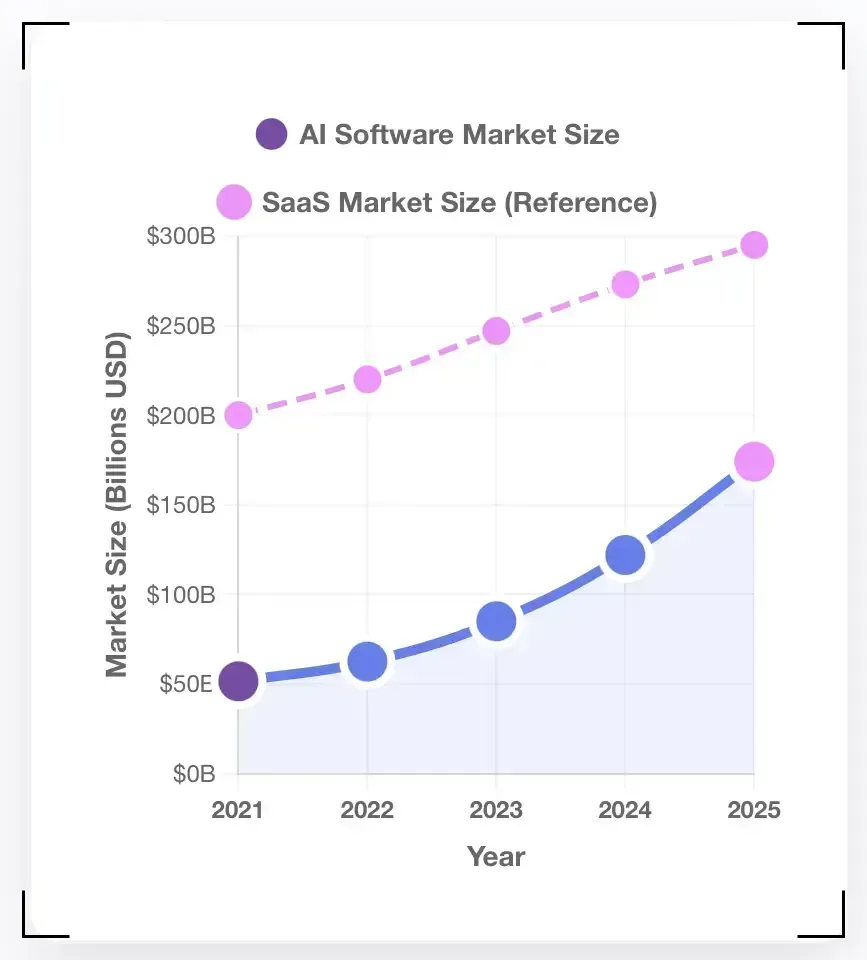

Global AI software spending is expected to cross $600 billion by 2026, growing nearly 2× faster than traditional SaaS markets, which are projected to grow at low double-digit rates.

You may have heard the phrase, "AI is Eating SaaS". It had gone viral. It was all over the internet. It literally became the meme of the town. And as a matter of fact, no one took it seriously. Now in 2025, the same set of people are speaking a different language.

See, when people say AI is eating SaaS, they don’t mean every SaaS company is doomed. What they mean is more uncomfortable: the value SaaS once delivered is being absorbed by AI systems that don’t need traditional software layers.

Classic SaaS products work like tools. They give humans interfaces, rules, and workflows — and humans do the thinking, clicking, and decision-making. AI agents flip this model. They don’t just assist inside the software. They perform the work that software used to organize.

Instead of logging into five tools to collect data, generate reports, and take action, AI agents can increasingly do this end-to-end. They read data, reason over it, decide what matters, and act — without waiting for a human to drive every step.

That shift doesn’t kill SaaS overnight. But it changes who holds the power.

In 2024–25, AI-native startups attracted over 35–40% of all enterprise software funding, up from less than 15% just three years ago.

Consider something as common as a weekly sales review in a mid-sized company. Earlier, this lived across half a dozen SaaS tools. CRM data came from Salesforce, pipeline reports were pulled from a BI dashboard, spreadsheets were updated manually, Slack messages flew around to clarify numbers, and a manager still had to interpret what changed and why. The software organized information, but humans did the real work—collecting, reconciling, summarizing, and deciding.

Now the same task looks very different with an AI agent in the loop. The agent reads live CRM data, compares week-over-week performance, flags unusual drops or spikes, correlates them with recent deals or customer behavior, and delivers a concise summary with suggested actions—before the meeting even begins. No dashboards to click through. No reports to export. No follow-up questions waiting on analysts. The “work” SaaS once enabled is increasingly being executed directly by AI, while the software itself fades into the background.

Traditional SaaS competes on features. More dashboards. Better filters. Faster exports. AI competes on outcomes.

Take something simple like reporting. A SaaS product might give you charts, trends, and toggles — but someone still needs to interpret them. An AI agent, on the other hand, can tell you what changed, why it matters, and what to do next, often without being asked twice.

This is why AI agents feel threatening. They don’t need users to learn the product deeply. They don’t rely on rigid workflows. They adapt. They decide. They execute.

The interface is becoming important than the intelligence behind it.

More than 60% of enterprise buyers now evaluate software based on “automation depth” rather than feature count, a sharp shift from pre-AI buying criteria.

This shift has hit SaaS where it hurts most: pricing and retention.

SaaS thrives on subscriptions. The promise is ongoing value for recurring fees. But when AI delivers results faster, cheaper, and with fewer tools involved, customers start questioning why they’re paying for multiple products that only manage parts of the job.

AI startups are also being valued differently. Investors aren’t just betting on user growth — they’re betting on labor replacement. When AI can do work that once required teams, the revenue potential feels larger, even if the product looks simpler.

That’s why funding is flowing aggressively toward AI-native companies, while traditional SaaS companies are being pushed to justify their pricing, margins, and long-term defensibility.

SaaS companies aren’t blind to this shift. Most are responding, but in different ways.

Some are embedding AI features into existing products: copilots, assistants, automated insights. This helps, but often feels cosmetic. AI becomes another feature tab, not the core engine.

Others are going deeper, rebuilding their platforms around agent-like behavior. Salesforce’s push toward “Agentforce” isn’t just branding — it signals an understanding that future users won’t manage software; they’ll manage AI workers operating inside it.

The companies that treat AI as a foundational layer and not an add-on, are the ones with a chance to stay relevant.

A clear example of a legacy SaaS company adapting to this shift is Microsoft and its transformation of Office. For decades, Word, Excel, and PowerPoint were productivity staples, but they relied entirely on humans to think, structure, and execute. The software provided powerful tools, yet the cognitive work always sat with the user.

With Co-pilot, Microsoft made a deliberate pivot. Instead of treating AI as a side feature, it embedded intelligence directly into how work gets done. Users no longer need to start from blank documents or manually explore spreadsheets. They can ask Co-pilot to draft reports, summarize meetings, analyze trends, or explain unexpected changes in data using plain language.

In Excel specifically, this shift is significant. Rather than building formulas and dashboards, users can ask Co-pilot questions like why revenue dipped in a particular region or what factors are driving growth. The AI reasons across the data and delivers insights, not just calculations.

This wasn’t Microsoft chasing hype or reacting defensively to ChatGPT. It was an acknowledgement that AI-native tools were beginning to replace work itself, not just software interfaces. By turning Office into an execution layer for AI, Microsoft ensured its legacy SaaS products evolved alongside AI agents instead of being side-lined by them.

The impact of AI is not evenly spread across the SaaS landscape. Some categories are feeling the disruption far more sharply than others, largely depending on the role the software plays inside an organization.

SaaS products built around information handling are the most exposed. This includes analytics platforms, reporting tools, customer support software, internal dashboards, and workflow automation tools. Their core job has always been to collect data, organize it, and help humans make decisions. As AI agents become capable of analyzing information, drawing conclusions, and even taking action on their own, the need for humans to operate these tools directly starts to shrink.

In these categories, AI doesn’t just improve the software—it questions its existence. If an AI can read raw data, explain what changed, and suggest or execute next steps, the value of logging into a separate tool to interpret charts or manage tickets becomes less obvious.

On the other hand, SaaS products that function as systems of record are far less vulnerable. Databases, ERP systems, accounting software, security platforms, and compliance tools manage core infrastructure—data integrity, access control, auditability, and reliability. These are areas where AI depends on stable foundations rather than replacing them.

The dividing line is becoming clearer. SaaS that exists to help humans think and decide is under pressure. SaaS that exists to help systems run and stay compliant is becoming even more critical in an AI-driven world

The next generation of software buyers isn’t asking, “What features does this tool have?” They’re asking, “How much work does this remove?”

Despite the panic, SaaS still matters. AI agents rely on infrastructure: databases, APIs, permissions, compliance layers, and secure systems. Much of that foundation is still SaaS.

What’s changing is where the value sits. SaaS is slowly becoming the operating layer beneath AI agents — less visible, less differentiated, but still essential.

The winners won’t be the companies with the most features. They’ll be the ones whose platforms are easiest for AI to operate on.

This shift is forcing everyone in the SaaS ecosystem to rethink long-held assumptions.

For founders, building software without an AI-first mindset is becoming increasingly risky. The challenge is no longer feature parity or design polish. What matters now is whether a product can move work forward on its own, with minimal human involvement.

Customer expectations are changing just as quickly. Many users no longer want additional dashboards, reports, or configuration options. They want fewer steps, fewer tools, and fewer decisions to make. The most compelling products are the ones where work simply disappears in the background.

Investors are reading the same signals. Capital is increasingly flowing toward AI-native companies that can replace entire workflows rather than SaaS tools that only optimize parts of them. In this new environment, the winners are not the products that help people manage work better, but the systems that quietly take work off their plate altogether.

So the quiet conclusion is: SaaS isn’t being eaten violently. It’s being digested.

AI is absorbing the most valuable parts of software — decision-making, execution, and adaptability — and leaving behind the infrastructure. The companies that recognize this early will evolve. The ones that don’t will still exist, but quietly, in the background.

AI isn’t killing SaaS.

It’s deciding what part of SaaS actually matters.

See you in our next article!

If this article helped you understand SaaS vs AI, check out our recent stories on Genz's new obsession, Perplexity's dominance, Wearable AI boom, GPT Store, Apple AI, and, Lovable 2.0. Share this with a friend who’s curious about where AI and tech industry is heading next.

Until next brew ☕