The Future Banker — Personetics

Running a small business today is a balancing act. Between managing cash flow, tracking payments, and planning for growth, business owners are constantly juggling numbers and decisions. But what if your bank could act like a financial co-pilot — spotting risks before they happen, offering smart advice, and helping you grow with confidence?

That’s exactly what Personetics is trying to do.

A 2024 Deloitte study found that 63% of small businesses struggle to maintain consistent cashflow visibility — often relying on outdated spreadsheets and manual tracking

Small businesses operate in a fast-paced, digital world. Yet, their banking experience often feels slow and reactive.

Imagine this — a restaurant owner checks their account only to realize they’re short on cash for payroll, or a local retailer misses an early loan payment because they were too focused on inventory.

These moments aren’t about bad management — they’re about timing and visibility. Business owners need a single, real-time view of their finances, across payments, expenses, and loans. More importantly, they need predictive insights, not just historical data.

And that’s where Personetics steps in.

Small businesses contribute over 40% of GDP in most major economies, yet less than 20% have access to advanced financial management tools. AI could close that gap

Personetics uses AI and predictive analytics to turn traditional banking into a smart, insight-driven experience.

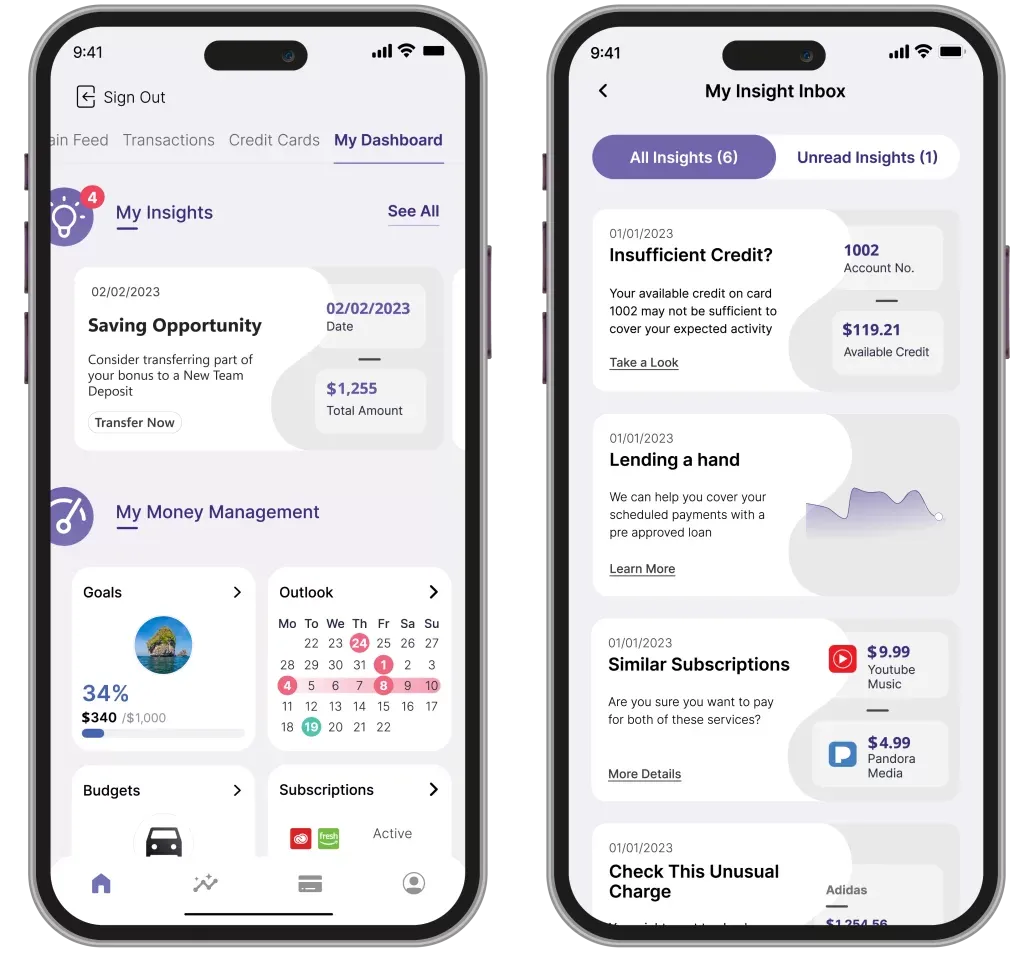

Here’s how it works — the platform connects to a business’s financial data, analyzes spending and payment behavior, and proactively surfaces insights through the bank’s mobile app.

Instead of waiting for a problem, Personetics helps prevent it.

For instance:

- It flags unusual transactions or missed payments before they become critical.

- It predicts cash shortages based on upcoming expenses and inflows.

- It even suggests corrective actions — like moving funds, optimizing payment schedules, or exploring credit options.

In simple terms, it’s like having an AI-powered financial advisor built directly into your banking app.

In pilot programs, Personetics reported a 35% increase in engagement among small business clients who received personalized cashflow insights.

Let's have a closer look at its offerings:

- Day-to-Day Banking Insights

Personetics simplifies daily financial management by highlighting important issues automatically — from sudden expense spikes to irregular payments — and suggesting next steps. - Cashflow Predictions

Using historical transaction patterns, Personetics forecasts future balances and alerts business owners about possible shortfalls, giving them time to act before it’s too late. - Mobile-Enabled Money Management

Every feature is built for mobility. Owners and employees can access insights on the go, track budgets, and even take recommended actions — all within their banking app. - Out-of-the-Box Business Insights

Personetics offers a library of prebuilt insights tailored to common small business needs — from cash management to growth opportunities — allowing banks to roll out AI-powered features faster. - Customized and Controlled by Banks

Through the Engagement Builder, banks can modify these insights, add their own, and fully control the user experience, ensuring it aligns with their brand and regulatory needs.

Personetics has succeeded and been able to create its market because of two important reasons:

First, for small businesses, cash flow is a matter of survival. And yet, traditional tools show what happened yesterday — not what’s coming tomorrow.

By bringing predictive intelligence and proactive guidance, Personetics helps small businesses move from being reactive to ready.

and second, the trust that the clients(banks) can bring using Personetics. When a business sees its bank actively helping it avoid risks and improve performance, that relationship deepens. Banks move beyond being just a service provider — they become a true partner in growth.

Personetics is making headlines and is not shying away from making money, too. They follow two pricing models. First is described as subscription-based, with tiered and value-based pricing for banks, meaning pricing is aligned with the size of the institution and value delivered.

The second one is for large institutions, which is called customized licensing & modules, meaning the total cost depends on the features selected, scale of deployment, and level of customization.

The services and the pricing models have made sure that the company is making money and enough to catch the eye of the investors. They have participated in two rounds of funding:

In early 2021, they raised $75 million from Warburg Pincus, contributing to their momentum in growth and expansion.

And in late 2021, the company secured over $160 million in funding, including an $85 million investment from Thoma Bravo.

The future looks promising, too. See, AI in banking isn’t new — but AI that understands businesses is.

Personetics shows how financial institutions can go beyond chatbots and dashboards to deliver contextual, personalized, and predictive banking experiences.

And the impact could be huge. Imagine if every small business could access real-time financial guidance — one that doesn’t just record data but interprets it, explains it, and acts on it.

If that’s very, very clear to you — the future of small business banking isn’t just digital; it’s intelligent, adaptive, and human-centered.

And Personetics might just be the one leading that change.

See you in our next article!